Career risk for buying Bitcoin is at an all time low for institutional portfolio managers and financial planners alike. To wit:

1.) Famed value investor Bill Miller announced live on CNBC that he is a Bitcoin bull. This actually shouldn’t be news to those who’ve been around a while, as Miller had half of one of the his hedge fund’s assets in bitcoin during the 2017 run up. Nevertheless, it had FinTwit (“Financial Twitter”) ablaze the the day this interview aired.

Similar to Paul Tudor Jones, Miller is opting for bitcoin futures. Hodlers would prefer that he buy actual bitcoin to take it off the market and reduce salable supply. Hopefully, he will be use the ICE Bakkt Bitcoin futures and take physical delivery, or otherwise come to take custody of real bitcoin for his firm.

2.) Days after Bill Miller’s CNBC appearance, legendary hedge fund manager Stanley Druckenmiller had is own CNBC interview in which he admitted to owning Bitcoin. Druckenmiller is considered by some to be the greatest investor of all time. This man’s words carry weight among the Wall Street crowd. This revelation again sent shock waves through FinTwit.

3.) A Guggenheim macro fund with $5B under management filed with the SEC to allow it to invest up to 10% of the fund in Bitcoin. The fund seeks to do it through the Grayscale Bitcoin Trust (ticker GBTC). Again, this is not ideal, as GBTC already has nearly 500,000 bitcoins, or over 2% of total bitcoin supply in their coffers. This makes it a huge honeypot for desperate governments. However, this is better than owning bitcoin exposure via say cash settled futures or Robinhood because GBTC actually owns bitcoin for every dollar under management.

4.) An analyst at commercial banking titan Citibank released a research piece focused on Bitcoin, and gave a price target of over $300,000 by the end of 2021. Mind you, this is simply one research analyst’s take at the bank. However, it is a report that is being distributed to institutional clients.

The whole of bitcoin’s existence has been characterized by major price swings, “exactly the kind of thing that sustains a long-term trend”

Thomas Fitzpatrick, global head of the company’s CitiFXTechnicals market insight product

5.) Rick Rieder, CIO of Blackrock, the the largest asset manager in the world, said he believes Bitcoin will take the place of gold.

The dominoes keep falling. More and more smart money is realizing the extraordinary value proposition of Bitcoin. A value proposition that is particularly powerful given the current constellation of economic, political, demographic, and social/cultural conditions.

To all those in disbelief: Yes, the smart money institutional investors are here, and they are feasting.

On this #Bitcoin rise, our data showed behavior from various holder sizes:

— Santiment (@santimentfeed) November 25, 2020

🐟 0.1-1.0 $BTC holders – began selling at $13.5k

🐠 1.0-10 $BTC – began selling at $15.2k

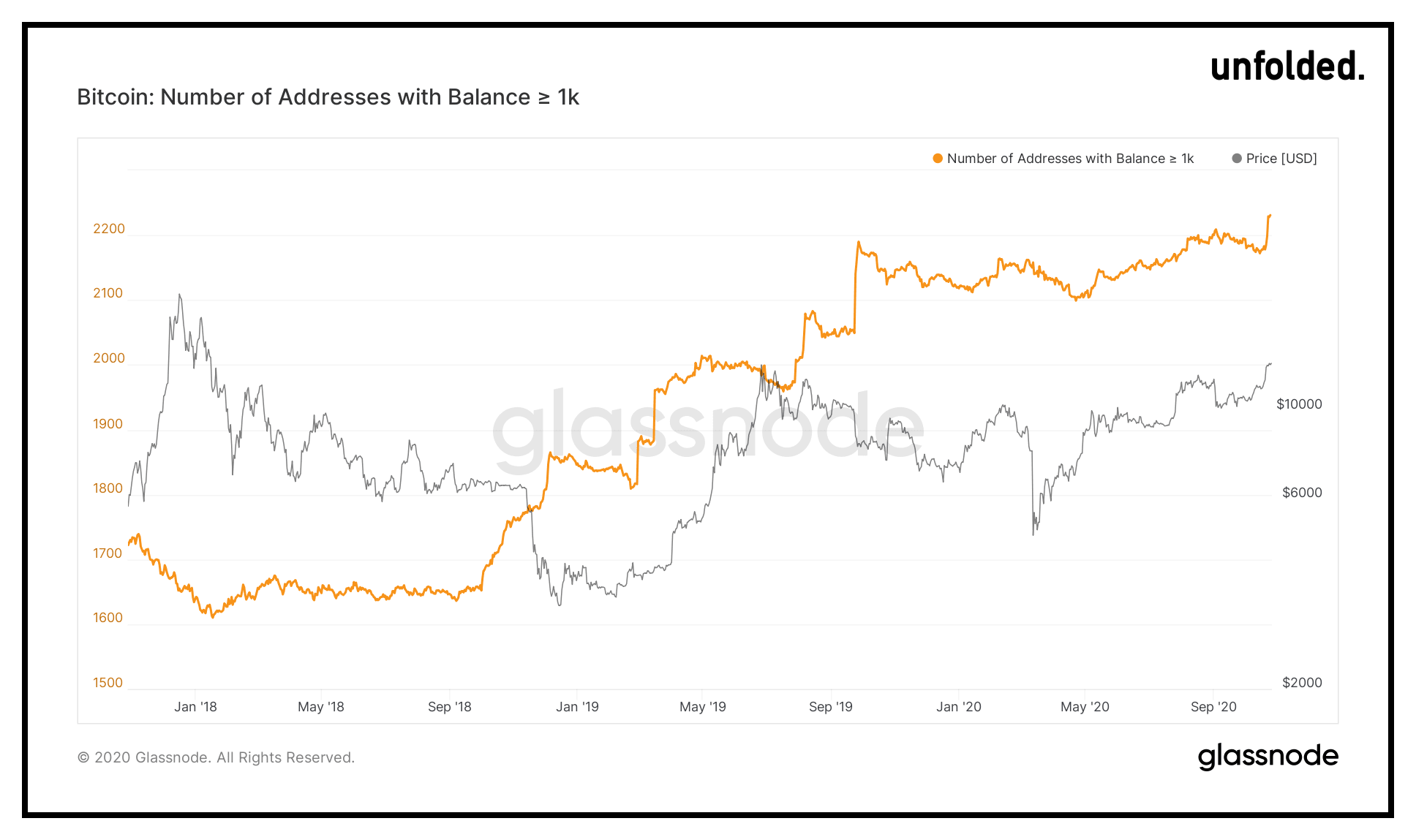

🦈 100-1,000 $BTC – began selling at $18.0k

🐳 1,000 – 10,000 $BTC – still accumulatinghttps://t.co/6V5iB7Ueuh pic.twitter.com/VZFZPqFuYF

One thought on “The Dominoes Keep Falling part 5”